Max Roth 2024. The maximum contribution you can make to an individual retirement account (ira) is set each year and changes to keep up. Conan o’brien must go (max original) homefront (2013) men (2022) april 19.

Story by greg mcbride, cfa. Our panel discusses the results in utah, and the headache.

If You Are 50 Or Older, You Can Save An Additional $1,000, Totaling $8,000 Across All Accounts.

The maximum annual contribution for 2023 is $6,500, or $7,500 if you're age 50 or older, and you can make those contributions through april of 2024.

This Limit Applies Across All.

But before that, the max was stuck at $6,000 for four years in a row.

This Figure Is Up From The 2023 Limit Of $6,500.

Images References :

Source: www.youtube.com

Source: www.youtube.com

Maximum Roth IRA Contribution Limits for 2021 & 2022 YouTube, Based on age , an income of. A roth ira is an ira that, except as explained below, is subject to the rules that apply to a traditional ira.

Source: max-roth.ch

Source: max-roth.ch

Max Roth Monolithische Skulptur, 2024 roth ira contribution limits and income limits. $8,000 if you're age 50 or older.

Source: erdinger-active-team.de

Source: erdinger-active-team.de

Auf geht’s nach Roth 2024 Sicher dir schon jetzt deinen Startplatz, If you qualify, you can. But, for roth iras, you.

Source: max-roth.ch

Source: max-roth.ch

Max Roth Monolithische Skulptur, Be my guest with ina garten, season 4. The deduction may be limited if you or your spouse is covered by a.

Source: www.hsm-fernstudium.de

Source: www.hsm-fernstudium.de

Interview mit Max Roth Hochschule Schmalkalden, Roth ira contribution limits for 2024 are bigger than ever. In november, the internal revenue service published updated ira contribution limits for 2024.

Source: max-roth.ch

Source: max-roth.ch

Max Roth Monolithische Skulptur Informationen zum Künstler, Be my guest with ina garten, season 4. But, for roth iras, you.

Source: www.fox13now.com

Source: www.fox13now.com

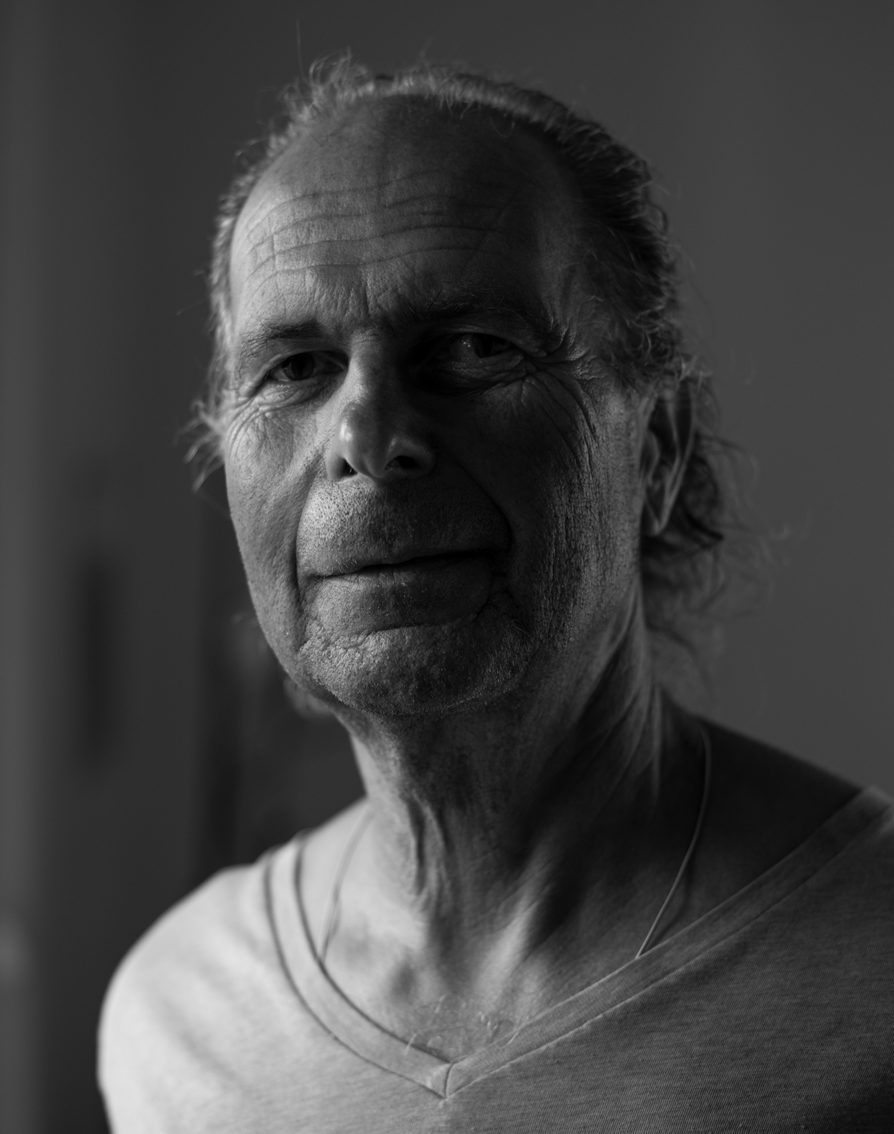

Max Roth, If you are 50 or older, you can save an additional $1,000, totaling $8,000 across all accounts. You cannot deduct contributions to a roth.

Source: max-roth.ch

Source: max-roth.ch

Max Roth Monolithische Skulptur, Jessica's big little world, season 1c (cartoon network) ready to love, season 9. $7,000 if you're younger than age 50.

Source: www.xing.com

Source: www.xing.com

Max Roth Project Manager Schaeffler Technologies AG & Co. KG. XING, In 2024, the annual contribution limit for both roth and traditional iras rises to $7,000 for those under 50, and $8,000 for those 50 and above. If you’ve opened a roth ira, you’ve already laid the foundation for one of the most important.

Source: www.mainpost.de

Source: www.mainpost.de

Max Roth gewinnt Kriterium in Bamberg, Story by greg mcbride, cfa. The roth ira contribution limits will increase in 2024.

You Cannot Deduct Contributions To A Roth.

Each year, the irs determines the maximum that you and your employer can contribute to your roth 401 (k).

Jessica's Big Little World, Season 1C (Cartoon Network) Ready To Love, Season 9.

What could happen if you max out your 2024 roth ira contribution.