Trad Ira Contribution Limits 2025. Learn about ira contribution limits to help shape your retirement savings plan, and ensure that you are financially. How much can you contribute toward an ira this year?

Less than $146,000 if you are a single filer. For tax years starting in 2024, an employer may make uniform additional contributions for each simple plan employee to.

Ira Contribution Limit Increased For 2024.

Your personal roth ira contribution limit, or eligibility to.

How Much Can You Contribute Toward An Ira This Year?

The maximum total annual contribution for all your iras combined is:

Trad Ira Contribution Limits 2025 Images References :

Source: choosegoldira.com

Source: choosegoldira.com

traditional ira contribution limits Choosing Your Gold IRA, For tax years starting in 2024, an employer may make uniform additional contributions for each simple plan employee to. Less than $146,000 if you are a single filer.

Source: www.slideserve.com

Source: www.slideserve.com

PPT Traditional Ira Contribution Limits PowerPoint Presentation, free, Get answers to all your questions about how much money you can put into your iras this year. You may be able to claim a deduction on your individual federal income tax return for the amount you contributed to your ira.

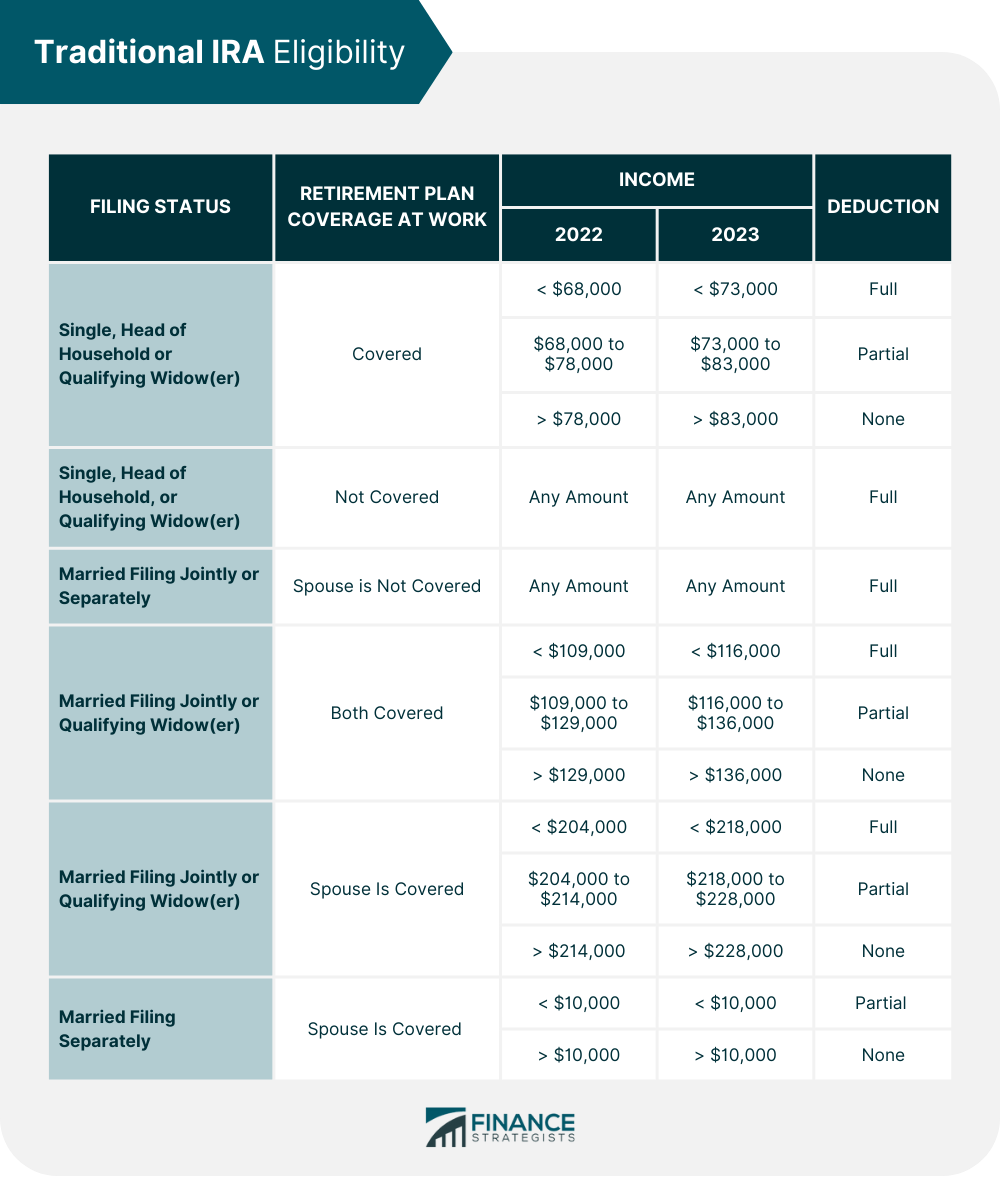

Source: www.financestrategists.com

Source: www.financestrategists.com

Traditional IRA Definition, How It Works, & Eligibility, Beginning in 2024, the ira contribution limit is increased to $7,000 ($8,000 for individuals age 50 or older) from $6,500 ($7,500 for. Anyone can contribute to a traditional ira, but your ability to deduct contributions is based on your income.

Source: www.slideteam.net

Source: www.slideteam.net

Traditional IRA Contribution Limits In Powerpoint And Google Slides Cpb, How much can you contribute toward an ira this year? The contribution limit for individual retirement accounts (iras) for the 2024 tax year is $7,000.

Source: www.slideserve.com

Source: www.slideserve.com

PPT Traditional Ira Contribution Limits PowerPoint Presentation, free, Less than $230,000 if you are married filing jointly. You may be able to claim a deduction on your individual federal income tax return for the amount you contributed to your ira.

Source: fity.club

Source: fity.club

Traditional Ira, These limits saw a big jump (relatively), which is. But your income and your.

Source: jocelinwdawn.pages.dev

Source: jocelinwdawn.pages.dev

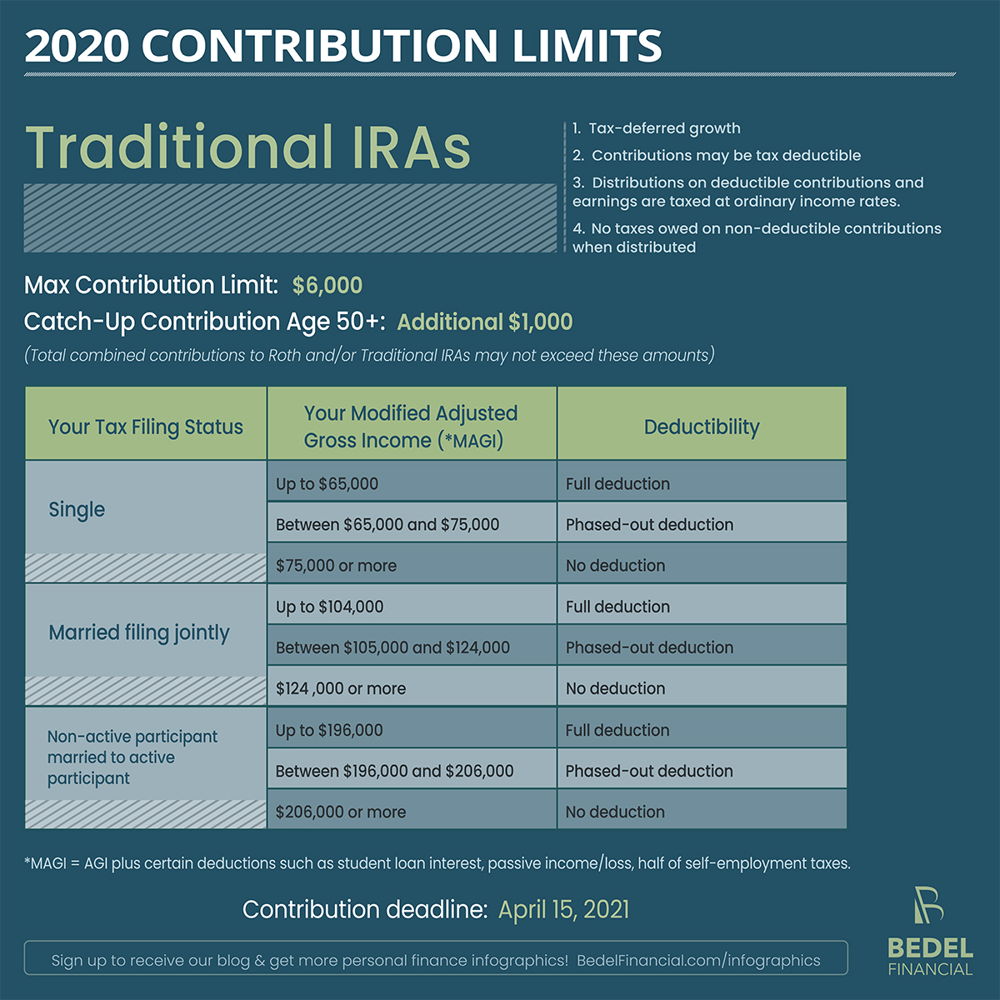

2024 Simple Ira Contribution Limits 2024 Single Deeyn Evelina, $6,500 (for 2023) and $7,000 (for 2024) if you're under age 50. How much can you contribute toward an ira this year?

Source: ninonqvalera.pages.dev

Source: ninonqvalera.pages.dev

401k 2024 Contribution Limit Irs Jorry Prudence, You may be able to claim a deduction on your individual federal income tax return for the amount you contributed to your ira. These limits saw a big jump (relatively), which is.

Source: meldfinancial.com

Source: meldfinancial.com

IRA Contribution Limits in 2023 Meld Financial, Both roth iras and traditional iras have contribution limits. These limits saw a big jump (relatively), which is.

Source: due.com

Source: due.com

3 Types of IRAs Due, This article provides a comprehensive overview of the current limits for individuals and employers. Both roth iras and traditional iras have contribution limits.

Less Than $230,000 If You Are Married Filing Jointly.

Explore traditional, sep, simple, and spousal ira contribution limits.

This Article Provides A Comprehensive Overview Of The Current Limits For Individuals And Employers.

$6,500 (for 2023) and $7,000 (for 2024) if you’re under age 50.

Category: 2025